The Challenge

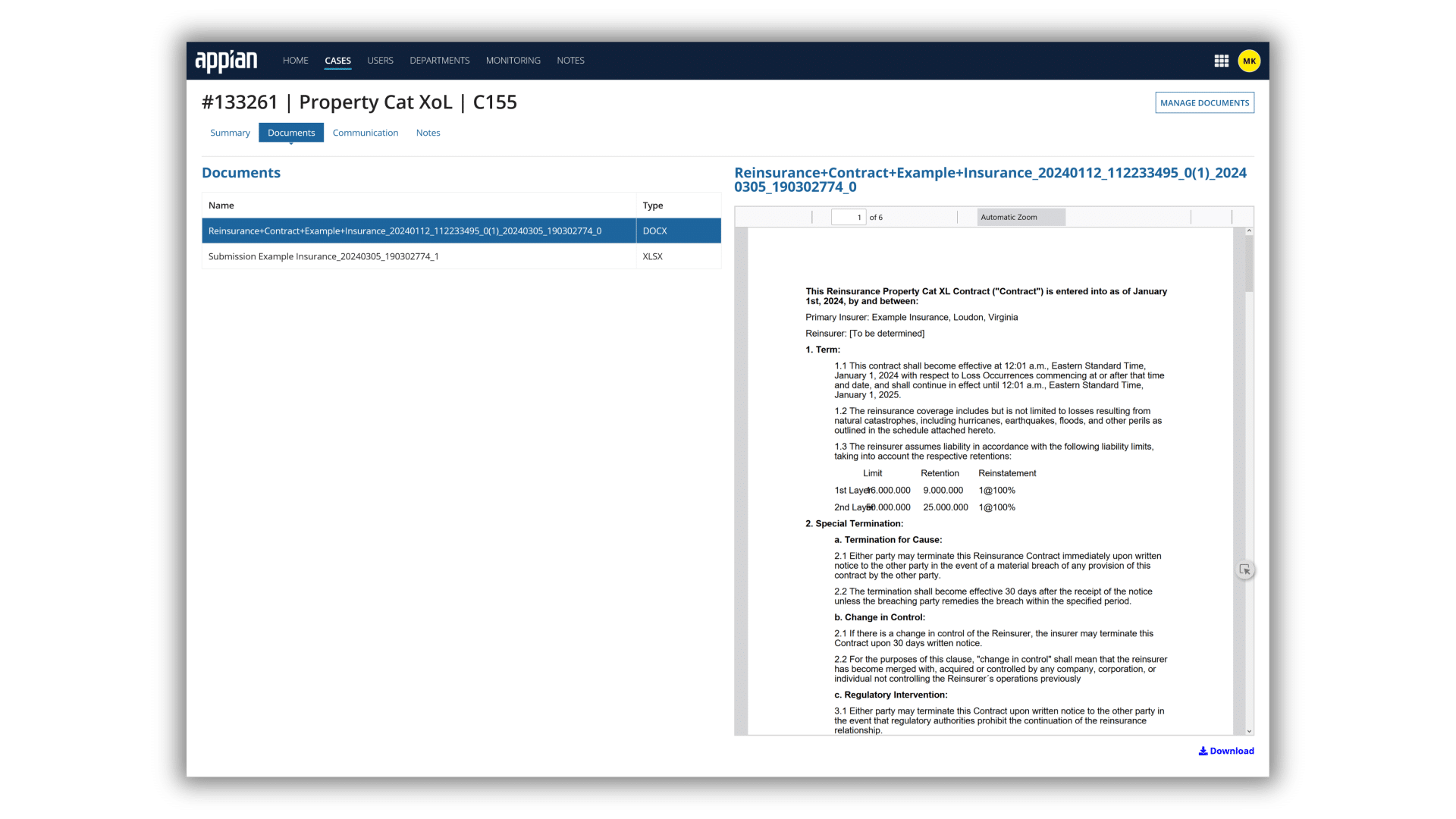

Rising costs, complex regulatory requirements, siloed data, and talent shortages present significant challenges for the reinsurance industry, creating bottlenecks that hinder rapid, accurate decision-making.

To remain competitive, it is crucial to adopt solutions that address these issues and adapt to future demands.

The Challenge

As pressure mounts on financial institutions to remain current and compliant with regulations across various levels of authority, encountering conflicts, inconsistencies, and missed deadlines is not uncommon.

To remain competitive, it is crucial to adopt solutions that address these issues and adapt to future demands.

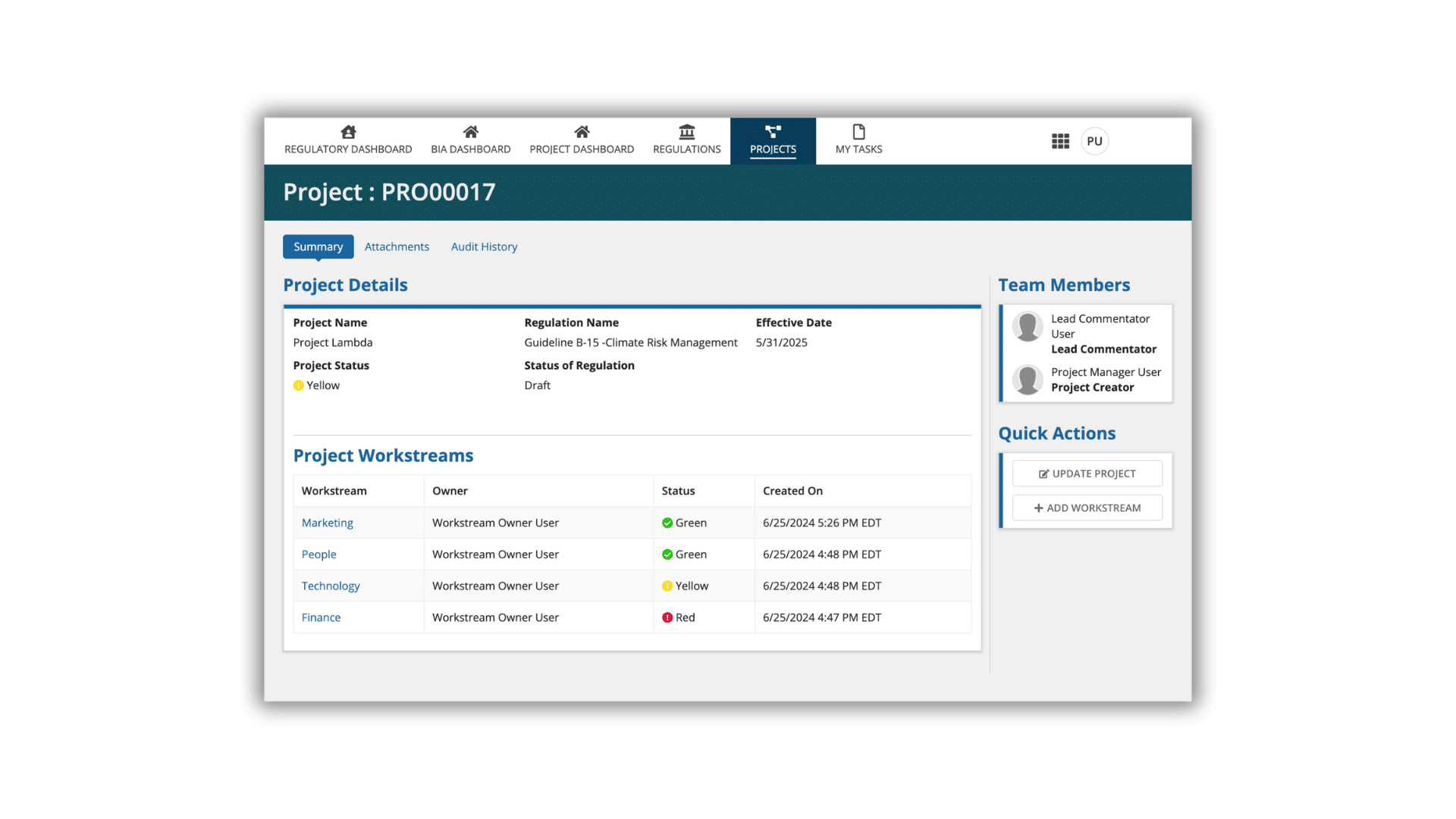

The Solution

Regulatory Change Management solution is a modular accelerator for financial institutions dealing with regulations, compliance, risk, and legal matters. The Horizon Scanning app is one of the critical components of this solution. Multidisciplinary teams can quickly identify, monitor, and manage regulatory changes and proactively address them.

With this early detection, teams can continuously evaluate how these changes might affect different aspects of the business such as people, policies, processes, customers, and technology.

Adapt Quickly while Managing Your Risk

-

Proactive Preparation

Stay ahead and better prepare teams for the effects of regulatory change

-

Consolidate Data

Unify data seamlessly from any source with simplified integration

-

Monitor and Action

Aggregate dashboards enable teams to monitor and action critical risk indicators.

-

Gain Control

Gain control of escalations and ensure accountability for follow-up action.

-

Search Quickly

Searchable data repository and workflow management makes it easy to find what you're looking for

Transform Horizon Scanning for Regulatory Change

- Built on a low-code automation platform, the system is designed to seamlessly integrate with existing systems and databases to manage regulatory data & workflows at multiple levels.

- Stay up to date on important changes in banking regulations

- Manage and prioritize regulatory changes, helping your bank stay compliant and avoid penalties.

- Meet commitements and deadlines, manage potential risks effectively, and provide detailed reporting.

- Monitor compliance activities, and carry out control testing after regulations come into effect

- Secure settings and firewalss prevent unauthorized access to data. Able permissions protocols.

Where in your business would automating complex processes and combining previously siloed data help your team make better decisions to get ahead of compliance?

Let’s start there.

Shared Benefits Across Your Teams

Compliance & Risk

Track the status of all regulatory change projects, ensuring proactive attention to those at risk of meeting enforcement deadlines. Enable 2nd and 3rd line teams initiate assurance activities on critical controls once implemented.

Internal Audit

Review Regulatory Change Management processes, assessing their design and operating effectiveness. Identify control weaknesses and unsatisfactory assessments, enabling timely reporting to the board.

Project Management

Expedite project planning around scope, budget, timelines, and resources. Enable project management capacity and resource planning and track, monitor, and report on project status.

Legal

Stay up to date on new regulatory developments, provide counsel to help meet commitments, and deliverables to avoid non-compliance, and leverage data for comprehensive reporting.

Future Proof Your Organization

Stay ahead of technology trends with a platform where digital agility is built-in at every level. Low-code ensures you’re able to innovate when you are ready. Don’t let vendors dictate your roadmap.